The Dark Side of Buy Now, Pay Later Coming to Gaming in 2025

Discover how Affirm's BNPL partnership with Xsolla fuels predatory microtransactions in gaming, risking gamers' financial health with enticing payment plans.

Just stumbled upon some seriously concerning news in the gaming world that I had to share with you all. Affirm, a buy now, pay later (BNPL) company, has teamed up with Xsolla to bring payment plans to in-game purchases. Yes, you read that right - you can now go into debt for your Fortnite skins! 🤦♀️

As someone who's spent thousands of hours (and yes, probably dollars) gaming, this partnership has me genuinely worried about where our industry is heading. The deal will let players split purchases into interest-free biweekly payments or longer monthly installments for purchases starting at $50. On the surface, it might sound convenient, but dig deeper and you'll see the predatory nature of this move.

The Predatory Economics Behind Gaming BNPL

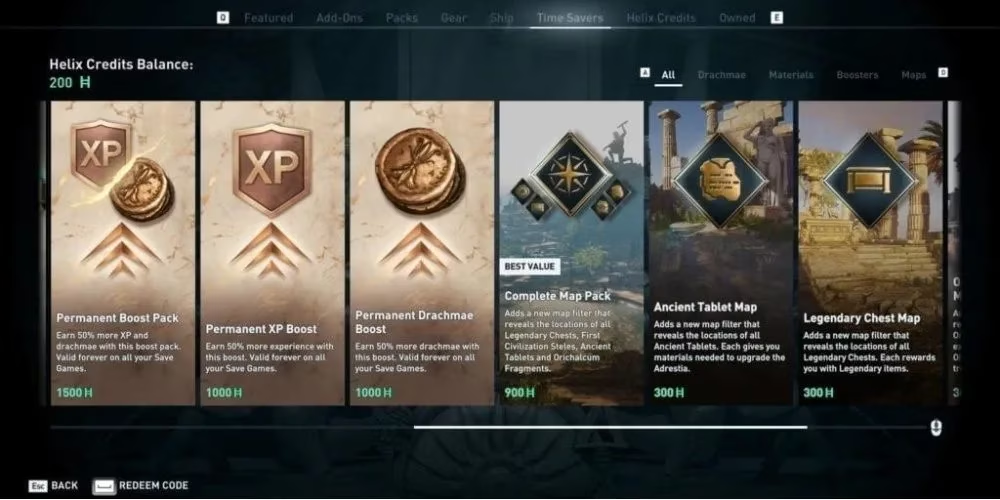

Let's be real for a second. Microtransactions are already controversial enough in the gaming world. I remember when games were a one-time purchase, and you got ALL the content! Now we're seeing free-to-play games with $20 skins, battle passes, and limited-time offers designed to trigger FOMO.

Fortnite and Roblox have faced lawsuits for making it too easy for kids to spend money. I've witnessed firsthand how these colorful, enticing cosmetics can lead to impulse purchases. Just last week, my nephew begged his mom for V-bucks because his favorite Fortnite skin was "about to disappear forever!" 😳

Now imagine adding a BNPL service on top of this. The psychological distance between spending real money and getting that shiny new skin just got even greater. It's no longer "Do I have $50 for this bundle?" but "Can I afford $12.50 every two weeks?" The answer feels easier, but the financial reality doesn't change.

My Personal Experience with BNPL

I'll admit something embarrassing - I once used a BNPL service for a gaming PC upgrade. What started as a "reasonable" payment plan quickly became stressful when unexpected bills came up. I made my payments on time, but it was tight, and the anxiety wasn't worth it.

BNPL companies like Affirm make their real money from people who miss payments and end up paying those hefty interest rates (up to 36% APR on monthly installments!). They're banking on financial vulnerability, not financial wellness.

And let's be clear - these companies aren't targeting people buying necessities. They're going after gamers who might make emotional decisions about digital items that have zero resale value. As someone who loves gaming, this feels like a betrayal of our community.

The Dangerous Combination of Microtransactions + BNPL

The most troubling aspect of this partnership is how it compounds existing predatory mechanics in games:

-

In-game currencies already obscure real value - 1,000 V-bucks sounds less painful than $10

-

Limited-time offers create urgency - "Get it now before it's gone!"

-

Now BNPL adds another layer of separation - "Don't worry about the cost today!"

I've watched friends fall into spending patterns they regret with regular microtransactions. One buddy admitted spending over $300 on Genshin Impact before realizing what had happened. BNPL would have made that $300 even easier to spend without feeling the immediate impact.

Who This Really Hurts

The corporate speak from Xsolla about "empowering developers" and "offering gamers a smarter way to pay" is pure marketing fluff. This system isn't designed for people who carefully budget their gaming expenses (like using a credit card for miles while paying it off monthly).

It's targeting:

-

Young gamers without financial experience

-

People living paycheck to paycheck

-

Gamers with impulse control challenges

-

Anyone vulnerable to FOMO marketing tactics

As we move through 2025, I'm seeing the gaming industry becoming increasingly aggressive with monetization. Remember when horse armor DLC in Oblivion caused outrage? Now we're normalizing going into debt for cosmetics! 😱

What We Can Do About It

I'm not saying all BNPL services are evil, but their introduction to microtransactions creates a potentially harmful combination. Here's what I'm personally doing:

-

Setting strict gaming budgets and sticking to them

-

Teaching younger gamers in my life about the real costs behind these systems

-

Supporting games with ethical monetization models

-

Speaking out when I see predatory practices

Have you encountered BNPL options in your gaming experiences yet? How do you feel about this development? I'd love to hear your thoughts and strategies for navigating this new reality in gaming. Drop your comments below!

And if you're struggling with gaming purchases, remember there's no shame in seeking help or setting boundaries. Your financial health is WAY more important than any digital item! ❤️ #GamingIndustry #FinancialLiteracy #GamerRights